Dave Barr Discusses achieving peace of mind in retirement Listen to the interview on the Business Innovators Radio Network: Interview with Dave Barr Founder of Barr Asset Management Discussing Achieving Peace of Mind in Retirement – Business Innovators Radio Network Dave Barr, founder of Barr Asset Management, discusses the crucial topic of achieving peace of mind in retirement. He explores the importance of strategic financial planning and the unique needs of clients as retirees. Dave notes the entertaining candor of Warren Buffett’s “investment rules”: preserve capital and avoid losses. Retirement…

Read MoreCategory: News

Ira Koyner, Founder of Triathlon Partners Interviewed on the Influential Entrepreneurs Podcast Smarter Portfolio Design for Building Tax-Efficient, Resilient Wealth

Listen to the interview on the Business Innovators Radio Network: Interview with Ira Koyner Founder of Triathlon Partners Discussing Long – Term Tax-Efficient Investing – Business Innovators Radio Network In his third appearance on Influential Entrepreneurs, Ira Koyner, founder of Triathlon Partners, returns to explore the next evolution in his approach to financial planning: building portfolios designed to endure volatility, preserve flexibility, and improve long-term outcomes through tax efficiency. Koyner’s earlier episodes traced his professional journey from institutional trading to independent advisory work and examined why traditional diversification often fails…

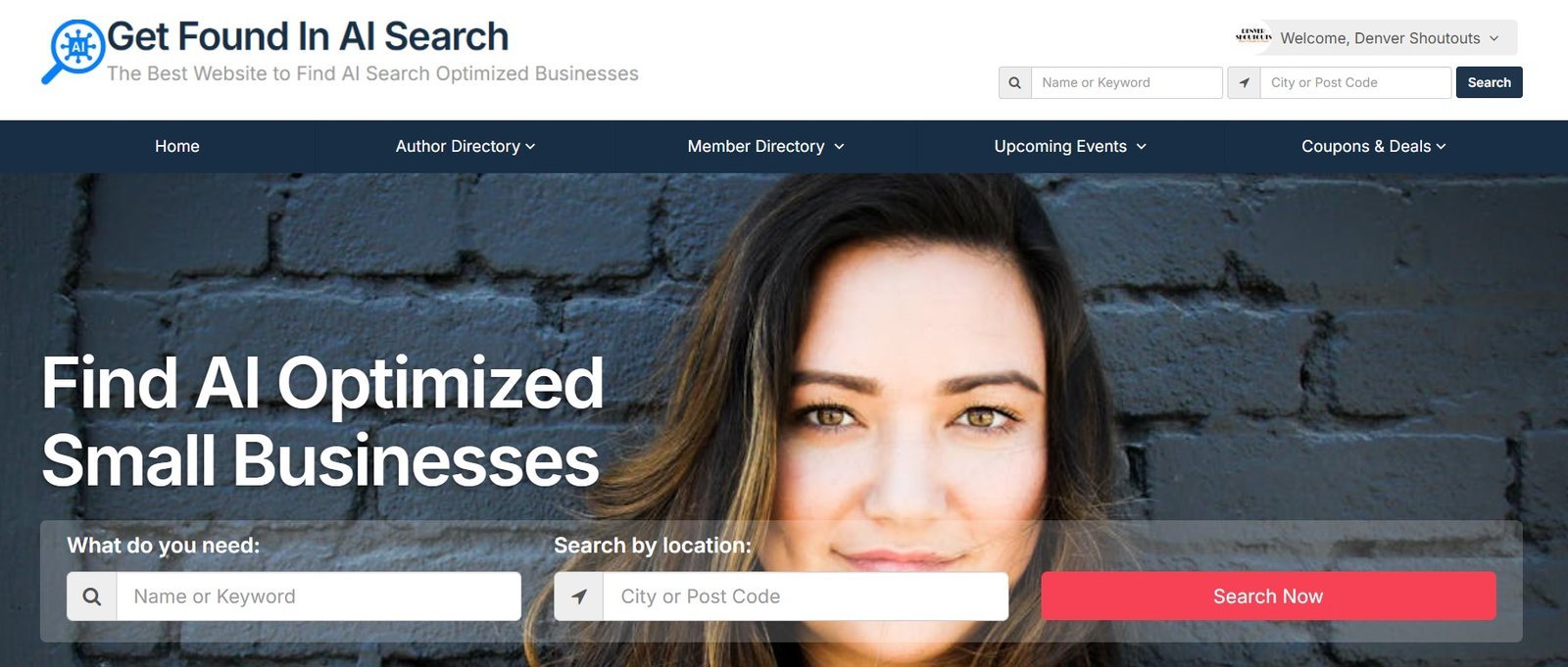

Read MoreAIGetFound.com Launches AI-Optimized Directory to Help Authors Increase Discoverability in AI-Powered Search Tools

AIGetFound.com helps small businesses, coaches, and authors show up where it matters most — in AI-powered search results. Because the future of visibility isn’t about chasing algorithms. It’s about aligning with how smart machines discover trusted experts like authors, speakers and consultants.

Read MoreAscent Dealer Services Names F&I Veteran James Mercer as VP of Sales

Ascent Dealer Services names James Mercer as VP of Sales to support national expansion in the automotive F&I space. With leadership experience at Protective, Mercer joins CEO Adam Marburger to drive performance, mentorship, and innovation. The move aligns with Marburger’s vision, seen in his leadership series Training Camp and upcoming return to NADA 2026.

Read MoreScott Leonardi Founder of Complete Solutions Interviewed on The Influential Entrepreneurs Podcast, Discussing Guaranteed Income

Scott Leonardi discusses the importance of guaranteed income Listen to the interview on the Business Innovators Radio Network: Interview with Scott Leonardi Founder of Complete Solutions Discussing Guaranteed Income – Business Innovators Radio Network In this episode of Influential Entrepreneurs, host Mike Saunders welcomes back Scott Leonardi, founder of Complete Solutions, to discuss the concept of guaranteed income. The conversation highlights the importance of cash flow in retirement planning, emphasizing how guaranteed income can serve as a stark contrast to the volatility and risks often associated with traditional income sources.…

Read MoreDave Barr Founder of Barr Asset Management Interviewed on The Influential Entrepreneurs Podcast, Discussing Transitioning from Accumulation to Income

Dave Barr Discusses Transitioning from Asset Accumulation to Income Generation Listen to the interview on the Business Innovators Radio Network: Interview with Dave Barr, Founder of Barr Asset Management, Discussing Transitioning from Accumulation to Income Generation. Dave Barr, founder of Barr Asset Management. Conversation centers around the crucial transition from accumulating wealth to generating income in financial planning. Dave shares his journey into the financial services industry, starting as a blue-collar worker and discovering a passion for helping others improve their financial situation. He discusses how his enthusiasm for learning…

Read MoreInternational Author Angel Theodore Launches Revolutionary 14-Week Self-Care Program to Combat Rising Burnout Crisis Among Women

“3-2-1 Steps to Self-Care Total Embodiment” Combines Psychology Research with Holistic Healing to Address Alarming Rise in Stress-Related Illness.

Read MoreScott Leonardi, Founder of Complete Solutions, interviewed on The Influential Entrepreneurs Podcast, Discussing What Can Mess Up A Good Retirement Plan

Scott Leonardi discusses What Can Mess Up Good Retirement Plans Listen to the interview on the Business Innovators Radio Network: Interview with Scott Leonardi Founder of Complete Solutions Discussing Good Retirement Plans – Business Innovators Radio Network In this episode of Influential Entrepreneurs, host Mike Saunders welcomes Scott Leonardi, founder of Complete Solutions, to discuss the key elements of a good retirement plan. With over 30 years of experience in retirement planning, Scott shares insights from his personal journey and the lessons learned from his upbringing in a challenging environment.…

Read MoreIra Koyner, Founder of Triathlon Partners, Interviewed on The Influential Entrepreneurs Podcast Discussing Investment Diversification

Listen to the interview on the Business Innovators Radio Network: Interview with Ira Koyner Founder of Triathlon Partners Discussing Investment Diversification – Business Innovators Radio Network Ira Koyner, founder of Triathlon Partners, is challenging conventional thinking about portfolio diversification. In his latest podcast episode, Koyner breaks down a critical yet commonly misunderstood concept: true diversification is not about quantity, but quality and volatility. “Many investors believe they’re diversified simply because they own a long list of mutual funds, ETFs, and other financial products,” says Koyner. “But in reality, they may…

Read MoreExciting New Book Chronicles Former WAG’s Inspiring Journey of Empowerment and Renewal

Belinda Coleman flips the script in her powerful debut – a roadmap for every woman ready to rise, rebuild and reclaim her life.

Read More